Risk management and dealing with complex risks have become the core challenge for organizations. With evolving threats and stricter regulation, the limitations of conventional risk management solutions become increasingly apparent. That is where agentic AI comes in and changes the way businesses detect, assess, and mitigate risk.

Agentic AI refers to artificial intelligence systems that have in-built autonomy and decision-making powers. As compared to traditional AI solutions, such sophisticated solutions identify risks and act decisively. They also adjust tactics, maintain regulatory compliance, and react to problems when they emerge. The combination of AI and risk management provides organizations with the ability to work in an active manner, protecting their business operations, information, and images.

This blog delves into the key role of artificial intelligence in risk management, with a focus on how agentic AI takes the lead in addressing current challenges. Using practical examples and industry experience, we will identify why agentic AI is a game changer and explore its implications on compliance, automation, and the future of risk management.

How agentic AI helps overcome complex risks

Risk management in regulated sectors like financial services, healthcare, and energy requires maintaining a delicate equilibrium between risk and compliance. Companies need to continuously keep track of changing regulations, mitigate cybersecurity threats, and stay compliant while maintaining operational effectiveness.

Agentic AI manages complex threats through autonomous real-time analysis of vast amounts of fluctuating data, pattern detection, and context-informed decision-making. It can model changing risk scenarios, forecast likely threats, and adjust its strategies in real-time through ongoing learning from new data. By eliminating human lag and predisposition, agentic AI allows for quicker reaction to crises like cyberattacks, system crashes, or regulatory violations, ultimately increasing agility and minimizing the collective effect of high-risk events.

Why is agentic AI vital for risk management

The real value of AI and risk management lies in its ability to evolve beyond supporting roles. Explore how agentic models reshape traditional thinking and provide new operational possibilities.

-

Autonomous threat detection and proactive response

Agentic AI allows organizations to detect and neutralize risks without the need to wait for intervention from humans. It independently searches through massive data sets, identifies anomalies, and automatically launches timely risk reactions. From detecting fraud to monitoring transactions in real-time, agentic AI systems are like ever-present guards that stop probable disruptions before they become major problems.

-

Real-time learning and ongoing adaptation

Unlike traditional static rule-based systems, agentic AI learns from fresh data and evolving conditions continuously. It learns to adjust in real time to changing risk profiles, regulatory changes, or operational irregularities. As threats change, so does the AI, keeping companies agile and responsive in quickly changing situations.

-

Predictive risk insights for smarter decision-making

With sophisticated methods such as predictive analytics and machine learning simulations, agentic AI provides deep foresight of upcoming risks. For instance, banks apply AI-driven simulations to evaluate investment results and fulfil financial regulations. This helps them make better-informed, strategic decisions backed by data-driven projections.

-

Dynamic and adaptive compliance management

Agentic AI constantly reconciles internal operations with revised laws and regulations, reconfiguring workflows, tracking transactions, and reporting real-time non-compliance. This dynamic ability serves especially well in decentralized settings like DeFi and in supply chains focused on ESG, where traditional compliance methods are ill-suited.

-

Strategic enablement for human teams

By streamlining tedious compliance checks and risk monitoring, agentic AI enables analysts to concentrate on strategy and planning of greater value. This improves productivity and enables human judgment to be utilized in tasks like reviewing AI decisions, handling exceptions, and shaping policy direction.

-

Futureproofing through simulation and scenario planning

Agentic AI can model potential disruptions through digital twins, digital replicas of key processes to assess how shifts in rules or operations might affect outcomes. This anticipation allows organizations to proactively make changes, building overall resilience and regulatory fit over the long term.

How does agentic AI impact regulatory compliance

For companies doing business in highly regulated sectors, keeping pace with ongoing regulatory evolution is time-consuming, labor-intensive, and high-risk. Conventional compliance practices typically depend on manual monitoring, siloed systems, and regular audits, which leads to mistakes and slow response rates. Agentic AI for risk management changes this completely.

Through the incorporation of autonomous monitoring and adaptive response, agentic AI makes compliance a continuous, real-time activity. It helps companies spot regulatory changes as they occur and implement internal policy, workflows, and documentation promptly, reducing risk and facilitating quicker adherence.

This leads to fewer compliance failures, quicker time-to-action, and significantly lowered operational operating cost. Agentic AI systems also give end-to-end traceability and transparency in decision-making, which makes internal audits and external regulatory audits easier. This way, organizations can better prove accountability, preserve brand reputation, and stay away from penalties.

Moreover, agentic systems reduce reliance on inflexible guides and allow businesses to scale up compliance across jurisdictions, products, and services without adding risk. For businesses like finance, insurance, and healthcare, where compliance is both critical and complex, this provides a solid foundation for sustainable growth and operational nimbleness.

Agentic AI in practice: Unique cybersecurity risk use cases

Agentic AI revolutionizes risk assessment through autonomous management of intricate evaluations, supporting scalability and accuracy. It intelligently processes immense streams of both structured and unstructured data utilizing advanced learning models to establish patterns and respond in real-time.

-

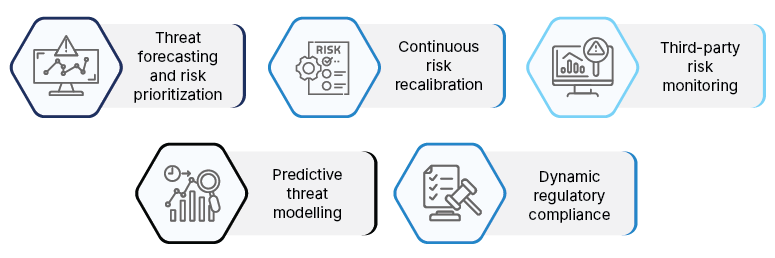

Threat forecasting and risk prioritization: From static to situational awareness

Agentic AI consumes telemetry data from endpoints, cloud workloads, user activity, and threat feeds, to create a contextual map of your firm’s digital landscape. It autonomously links anomalies, prioritizes risks by potential business exposure, and can initiate pre-approved mitigation. Sometimes, even before human analysts become aware of the threat. This real-time, consequence-driven prioritization reduces Mean Time to Detection (MTTD) and ensures that enterprise-level risk detection is enacted at machine speed.

-

Continuous risk recalibration: Security that adapts to the business

Regular audits are redundant when business architectures change daily. Agentic AI is continuously operating in a state of feedback loop, adjusting controls as new integrations, cloud deployments, or workforce behaviors arise. It highlights misalignments between security posture and business priorities in real time, keeping risk management always up to date, never lagging.

-

Third-party risk monitoring: Scaling trust throughout the supply chain

Vendor and SaaS risk is existential today. Agentic AI enables third-party risk monitoring through the automated tracking of partner behaviors, access patterns, and configuration drift. It brings vulnerabilities to the surface throughout your extended ecosystem to allow real-time intervention. For CROs, this translates to scalable, evidence-based monitoring, without manual review backlogs.

-

Predictive threat modelling: Anticipating the next attack vector

Agentic AI uses historical and current data to simulate potential attack vectors and new threat trends. It doesn’t merely respond to past breaches; it anticipates future threats as well. This predictive nature enables the management to move from defensive actions to pre-emptive governance, directing resources to most likely and impactful risks.

-

Dynamic regulatory compliance: Automating the burden of change

As regulations move at the fastest pace ever, agentic AI constantly monitors for regulatory changes and self-modifies internal controls and compliance models. It marks obsolete processes and recommends automated remediation, staying aligned to global standards-while avoiding delay and expense of manual compliance checks. This proactive compliance stance minimizes the risk of fines and damage to reputation.

What are the challenges in implementing agentic AI solutions

Agentic AI offers a few challenges, specifically in terms of accountability, data privacy, and the dangers of over-reliance on autonomous decision-making. These issues necessitate the development of governance systems to guarantee AI systems conform to ethical principles and business goals:

-

Accountability in independent decision-making

The principal difficulty with agentic AI is accountability when systems take decisions independently. In contrast to conventional AI, which operates under fixed rules, agentic AI autonomously takes decisions, occasionally with unanticipated effects. Liability concerns arise in terms of whether the AI developer, deploying organization, or some other party is responsible.

Create a well-defined structure of shared responsibility among AI creators, deploying entities, and regulatory authorities. Adopt traceability features and decision-logging so that all agentic activity can be audited and traced back to the responsible entity.

-

Risk of data privacy and security

Agentic AI relies on large datasets, rarely including sensitive data. Illegal access, data misuse, or opaque decision-making are probable risks in the absence of effective data governance. Obedience with regulations such as GDPR and CCPA should be maintained to make consumers aware and secure their data.

Adopt strong data governance policies, including encryption, role-based access control, and anonymization where possible. Regularly audit compliance with privacy regulations like GDPR and CCPA, and ensure users are informed about how their data is used.

-

Over-reliance on agentic systems

Dependence on agentic AI may reduce human control in vital decision-making. While AI can competently process information and automate processes, it may lack the nuanced decision needed for intricate, high-value decisions. This is especially challenging in areas like medicine, finance, and law, where moral considerations are part of the decision-making process.

Have a human-in-the-loop model for high-stakes or morally delicate decisions, where ultimate control lies with competent professionals. Establish specific thresholds of AI autonomy and refer cases to human judgment when contextual judgment is necessary.

-

Ethical governance and transparency

Organizations need to have ethical governance mechanisms in place that plan AI responsibilities, decision limits, and expectations of openness. These include explicit documentation of AI rationale, decision audit logs, and mechanisms to authenticate results generated by AI.

Establish internal AI ethics boards and guidelines that direct system design, deployment, and control. Maintain decision transparency with model explainability technologies, documented audit trails, and regular performance assessments to identify bias or drift.

Agentic process automation risk management and its techniques

Agentic Process Automation (APA) is a sophisticated level of automation in which AI agents have the capability to execute complex business operations on their own. In contrast to conventional automation systems, APA systems show autonomy, flexibility, and decision-making abilities. Intelligent agents learn from the surroundings, interact with more than one system, and get better with time.

1. Risk identification and valuation

| Risk mapping | Classify all probable risk sources and associate them with a particular APA use case. |

| Impact analysis | Assess the severity and probability of each risk to determine priority for mitigation. |

| Scenario simulation | Employ digital twins or simulation to watch as agents react to anomalous or unexpected conditions. |

2. Governance and supervision

| Human-in-the-Loop (HITL) | Ensure manager’s supervision for key decisions, especially when actions have legal or ethical repercussions. |

| Role-Based Access Control (RBAC) | Control agents’ actions by role and authorization to prevent overreach. |

| Audit trails | Log all agent actions and secure them for transparency and traceability. |

3. Technical risk reduction approaches

| Explainable AI (XAI) | Implement models that offer explainable decisions so that humans can see and verify agent behavior. |

| Testing and validation pipelines | Test agent behaviors continuously against edge cases, anomalies, and adversarial inputs. |

| Fail-safe and rollback mechanisms | Implement agents with the capability to roll back to secure states or terminate execution if there is abnormal behavior. |

4. Constant monitoring and feedback

| Real-time monitoring dashboards | Monitor agent performance, irregularities, and compliance metrics in real-time. |

| Adaptive control systems | Utilize feedback loops where agents can be revised based on performance data. |

| Incident response plans | Create procedures to rapidly react to agent incidents, including rollback, shutdown, and remediation. |

5. Regulatory procedures

| Policy alignment | Align agent goals and actions with organizational policies and external regulations. |

| Bias detection tools | Employ analytics and monitoring tools to identify and overpower biased behaviour in learning agents. |

| Third-party audits | Conduct recurrent independent reviews of APA systems to confirm agreement with laws, industry standards, and ethical procedures. |

Agentic AI and upcoming risk management trends

What lies ahead for AI and risk management will depend on how businesses balance autonomy, trust, and agility. Here’s a look at the evolving horizon of intelligent risk practices.

-

Broader adoption across sectors

Agentic AI is gaining traction across industries like finance, healthcare, energy, and manufacturing, where high-stakes, time-sensitive decisions are critical. In finance, it delivers strong value for banks and insurance companies through automated fraud detection, credit risk modeling, and real-time compliance monitoring. Ultimately, any industry exposed to large-scale, high-impact risks can benefit from agentic AI’s agile and autonomous risk management capabilities.

-

Enhanced decision-making functions

As machines learn, agentic systems will be increasingly able to make high-risk decisions in complicated situations, like during a financial breakdown or cyber-attack. These systems leverage continuous learning, simulate high-stakes risk scenarios, forecast potential outcomes, recommend mitigation strategies in real-time, and autonomously initiate containment or corrective actions to reduce exposure and impact.

-

Human-AI collaboration

Although agentic AI has the ability to make decisions independently, we assume that human oversight will remain essential. In the future, risk managers will collaborate with AI systems to review decisions and intervene when appropriate, merging the strengths of both.

-

Integration with other technologies

The integration of agentic AI with other technologies such as blockchain, IoT, and edge computing will result in safer and more responsive risk management models. AI will become essential to real-time operational decision-making, enabling adaptive risk avoidance on scattered networks.

Moving forward with smarter risk strategies

Agentic AI represents a shift in how organizations understand and respond to risks. As businesses face growing uncertainty and tighter compliance demands, the ability to act with speed, precision, and autonomy becomes a strategic advantage.

What sets agentic AI apart is its capacity to think and act independently, learn from every decision, and dynamically adjust to new inputs. This means risks are anticipated, interpreted, and addressed in real time.

Investing in agentic AI is about building flexibility, improving decision-making, and creating risk strategies that grow stronger with each challenge. To know more about how agentic AI services will help you in efficient risk management for your organization, connect with our AI experts.