AI can catch fraud – with speed, accuracy, and scalability. It can scan thousands of transactions in real time for suspicious behavior, catch the right signals, and learn from previous fraud cases.

To give you an example:

Decision Intelligence Pro, an AI system by Mastercard, shows an increase in fraud detection rates on average by 20% and can go as high as 300% in some instances.

Source: Mastercard

Therefore, businesses across industries are turning to AI-powered fraud detection to mitigate increasingly sophisticated threats. Especially in banking and financial services, where transaction volumes are high and fraud risks are significant, Artificial Intelligence (AI) helps detect anomalies faster, filter out false alerts, and protect both customers and revenue.

In this blog post, we will share AI’s role in fraud detection, followed by technologies, strategy, and use cases so that you can implement it, with clarity, and for impact.

How is AI used in fraud detection processes?

AI is used in fraud detection to turn complex behavior into clear signals. It can detect patterns, track behavioral shifts, learn from data, and adjust faster than fraud can adapt. Let’s see how.

-

Supervised learning

Supervised learning is a process in which AI systems are trained on specific fraud tactics using labeled data. For example, a dataset can include thousands of regular transactions alongside flagged cases such as sudden high-value purchases or transfers to suspicious accounts. Such a technique guides pattern recognition and works best for detecting known or common types of fraudulent behavior.

-

Unsupervised learning

Unsupervised learning is an anomaly detection technique that helps go beyond supervised learning’s limitations, such as reliance on labeled data and its inability to detect unknown or emerging fraud patterns. Its purpose is to train AI models to recognize previously unpredicted (and yet unusual) behavior patterns.

-

Reinforcement learning

Reinforcement learning is a trial-and-error technique where AI systems learn by interacting with data. They receive feedback, negative or positive, for their actions. And over time, they refine their decisions based on what leads to better outcomes such as correctly flagging fraud. It is extremely helpful in fraud detection environments that keep changing, and hence, the models must adapt their behavior consistently.

-

Anomaly detection

Anomaly detection is a pattern recognition technique in which AI systems use statistical models to identify and flag unusual behavior. For example, it creates an alert when a user who typically makes small local purchases suddenly initiates a high-value international transfer. It does not require prior examples of fraud and solely relies on a primary understanding of what is usual or typical. Therefore, it is useful for spotting subtle and new types of fraud early.

-

Risk scoring

Risk scoring is a preventive technique which is also a part of the early warning system. It uses AI and machine learning models to assign probabilities to potential actions based on the weighted data. It assigns risk levels to each transaction, user, and account based on various factors. They can include transaction size, device used, location, and past behavior.

-

Network analysis

Network analysis helps AI systems find hidden networks (relationships) between users, accounts, and/or transactions. It maps connections as well as interactions such as shared devices, IP addresses, and fund transfers. The purpose is to detect organized fraud rings and collusions. For example, if multiple accounts are traced back to the same device, the system can flag them as a part of a suspicious network.

-

Text analysis

Text analysis is one of the important fraud detection systems that employs AI to process and analyze unstructured textual data. Such data includes emails, chat messages, and transaction memos. For example, repeated use of certain phrases in scam messages can be flagged as suspicious.

-

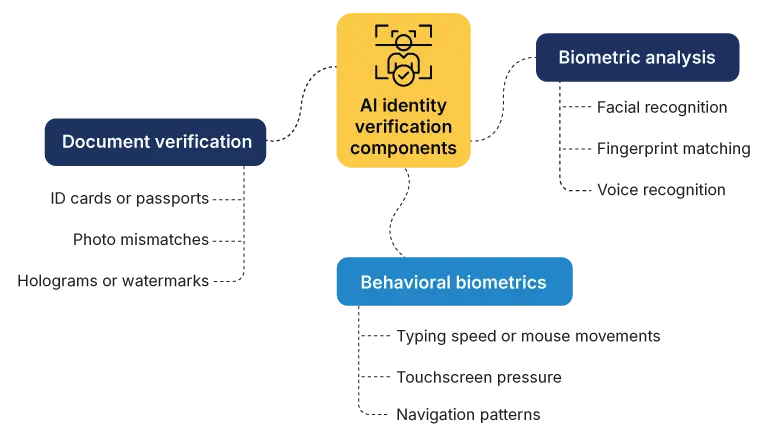

Identity verification

Identity verification is a technique in which AI validates if a person (or user) is who they claim to be. The system can use biometric analysis, document verification, and behavioral biometrics. For example, if someone tries to open multiple accounts using slightly altered details, AI can cross-check identity and create an alert.

-

Adaptive learning

Adaptive learning is a technique which uses AI systems to adapt to new information such as emerging fraud detection patterns. For example, if a new scam begins circulating such as social engineering that targets mobile banking apps, AI can learn from patterns in user behavior and flagged interactions, and then quickly update its models to recognize and respond to threats.

Differences between traditional and AI-powered fraud detection systems

There are eight major differences on all levels, including approach, process, and implementation. With increasing AI-led attacks, an AI-led defense system is a natural choice. However, learning the major differences helps organizations make informed decisions about upgrading their fraud prevention strategies.

| Aspects | Traditional fraud detection | AI-powered fraud detection |

|---|---|---|

| Approach | Rule-based. It follows the manual process. | Pattern-based. It can function autonomously with learned behavior. |

| Adaptability | Static. Its rules must be updated manually by a team of AI engineers. | Dynamic. It can continuously learn and adapt to new fraud patterns. |

| Detection type | Reactive. It only responds after rules are triggered. | Proactive. It detects emerging and unknown threats. |

| Human involvement | High. Because it depends on expert-defined rules. | Lower. Because it highly relies on data-driven insights. |

| Context awareness | Limited. Often ignores behavioral signals. | High. Because it incorporates user behavior, device info, and location. |

| False positives | High. Many legitimate transactions may be flagged. | Low. Better precision through personalized and behavioral analysis |

| Speed | Slower. It is limited by manual review and rule creation. | Faster. It can process and analyze large volumes of transactions. |

| Use of data | Minimal. Only basic transaction data used | Extensive. Uses structured and unstructured data. |

How can AI prevent fraud?

AI prevents fraud by identifying suspicious activities early and accurately. It uses predictive analytics to forecast potential fraud based on patterns, anomalies, and contextual signals across vast volumes of real-time data. And hence, businesses like yours can act before a fraudster uses AI to process unauthorized transactions.

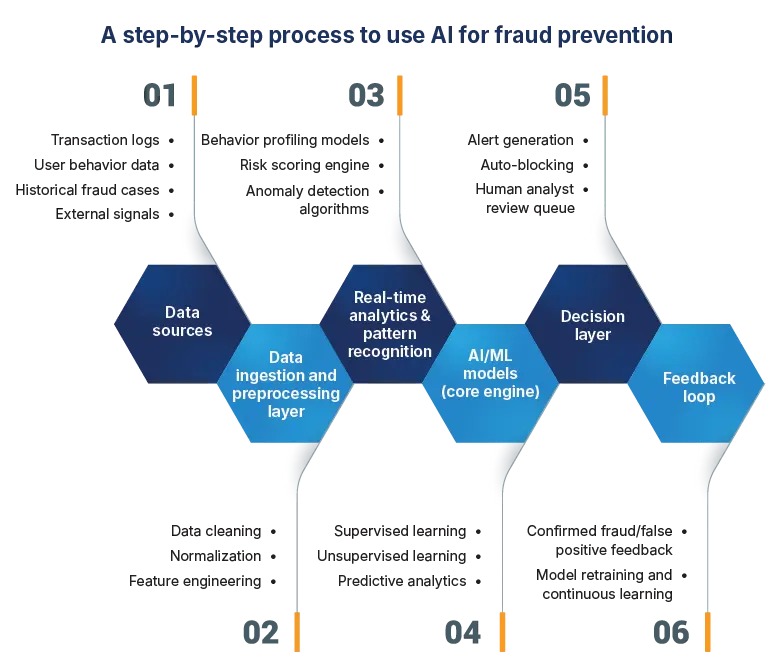

A typical fraud prevention method with AI includes data sources, ingestion and processing, pattern recognition in real-time, AI and ML models processing, and a decision layer.

What are the key AI technologies for fraud detection?

There are four AI technologies that detect and prevent fraud. While their application depends on specific objectives, each technology brings unique capabilities that increase the accuracy, speed, and adaptability of fraud detection systems.

Let’s learn their primary usage:

- Machine Learning (ML) algorithms such as decision trees, support vector machines, and random forests can detect patterns and anomalies in transactional data.

- Deep learning (RNNS and LSTM) can analyze sequential data, such as time-series transactions. They can also detect subtle, temporal patterns in user behavior.

- Graph Neural Networks (GNNs) can uncover complex relationships between entities like accounts, users, or devices. They are especially useful in identifying fraud rings, account takeovers, and collusive behavior.

- Natural Language Processing (NLP) techniques analyze unstructured data such as emails, chat logs, or reviews. They help catch inconsistencies, suspicious language patterns, and sentiment shifts.

How to build an AI fraud detection strategy

Building an AI fraud detection strategy means aligning data, AI and ML models, and monitoring tools. While the specific strategy depends on the industry, organization size, and particular objectives, there is a general framework that, if followed, can be highly effective in detecting fraud.

1. Build an AI fraud detection team

You can assemble a cross-functional team that is well connected within your business ecosystem. While choosing the team members, ensure to bring unique expertise in various areas:

- Data science

- Cyber security

- Domain knowledge

- Engineering

Additionally, establish communication channels between technical experts and business stakeholders. It will help you build AI and ML models that are both accurate and practical for your business scenario.

2. Define objectives and risk tolerance

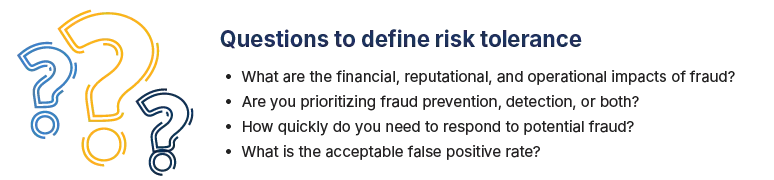

Define the scope of your fraud detection efforts. First, decide which types of fraud to detect. They can include payment fraud, identity theft, account takeover, and application fraud. To choose the right types of fraud, consider your business model, customer base, and known threats.

Next, establish your risk tolerance. You can determine what level of fraud risk your organization can accept versus the potential cost of false positives.

3. Collect and prepare data

A solid AI fraud detection system needs high-quality, relevant data because the results depend on it. Therefore, you must gather various types of data:

- Historical fraud data

- Transaction logs

- User behavior patterns

Once data is collected, it must be cleaned (to remove errors or inconsistencies), labeled (for differences between fraudulent and legitimate events), and anonymized where necessary to comply with privacy regulations.

4. Choose appropriate AI and ML models

Select AI and ML models that fit your objectives, which means the fraud types you decided to prevent and detect. There are many types, and each has a specific function. You can consult an AI engineer to find the model.

AI and ML models for fraud detection

- Logistic regression

- Decision trees

- Random forests

- Gradient boosting

- Neural networks

- And more

Depending on your requirements, you can also choose hybrid models that combine supervised and unsupervised learning. It will ultimately help you detect both known and novel fraud patterns.

5. Engineer features and train models

Model performance depends on feature engineering. Therefore, extract important and absolutely meaningful features from your collected data. The goal is to highlight patterns and anomalies so that you can distinguish fraudulent transactions from legitimate ones.

A few feature examples to extract from your data

- Transaction velocity

- Geolocation inconsistencies

- Device fingerprinting

- Behavioral deviations

- And more

6. Implement real-time monitoring

The next and final step is deploying AI and ML models into a production environment with real-time monitoring facilities. You can receive alerts when any type of suspicious behavior is detected. While some AI systems can automatically intervene (For example, transaction block and additional user verification) and resolve, some send messages for immediate investigation.

7. Ensure regulatory compliance

Your AI fraud detection system must comply with both local and international regulations. It helps avoid legal risks and builds trust with customers. Some key regulations are:

- GDPR (General Data Protection Regulation)

- PCI DSS (Payment Card Industry Data Security Standard)

- CCPA (California Consumer Privacy Act)

- Industry-specific such as HIPAA for healthcare

Therefore, make compliance a part of your strategy. To ensure full alignment, you can consult legal teams and partner with an AI fraud detection solution provider that understands the regulatory landscape.

Use cases of AI in fraud detection

AI helps organizations shift from reactive fraud defenses to proactive and real-time prevention. While it is absolutely helpful for all businesses regardless of their domain and size, there are a few industries where threats are higher and therefore, AI is a necessity for them. Let’s learn.

1. Banks and financial services

They handle high volumes of daily transactions. Therefore, they are the prime targets for fraud. Here, AI identifies fraudulent behavior and saves significant losses.

- Transaction fraud detection: AI models analyze real-time transaction data and flag any unusual activities such as rapid withdrawals and purchases.

- Account takeover detection: Behavioral biometrics can use pattern recognition to detect if someone other than the account holder is trying to access it.

- Loan application fraud: AI can detect inconsistencies in loan applications by cross-referencing internal and external data sources.

2. Insurance

Insurance fraud can be complex and costly. AI helps insurers catch opportunistic as well as organized fraud schemes. It can examine data across claims and customer profiles.

- Claims fraud detection: AI reviews claim details, historical patterns, images, and documents to effectively detect exaggeration, duplication, and false claims.

- Policy fraud detection: AI can analyze application data to detect inconsistencies or forged documents to catch if someone is securing a policy under false pretenses.

- Fraud ring detection: Graph-based AI models can identify connections between seemingly unrelated claims to flag any organized fraud networks.

3. E-commerce and retail

Online retailers face a range of fraud types. They have to handle fake transactions, fake accounts, return abuse, promotional exploitation, and more. Here, AI can protect revenue.

- Payment fraud: AI detects unusual behavior like multiple failed attempts, mismatched locations, and stolen card numbers. And then, prevent transactions.

- Fake accounts and bots: AI can easily spot non-human patterns and prevent automated bots from exploiting discounts.

- Return fraud: AI models can analyze purchase and return histories to flag customers who repeatedly abuse return policies or commit item-switching fraud.

4. Telecom

Telecom providers have to manage frauds like fake subscriptions, international calling scams, and misuse of services. AI can detect such instances early and help resolve them.

- Subscription fraud detection: AI can detect suspicious account openings such as those using stolen or fabricated identities.

- Call and SMS fraud detection: AI models can monitor call durations, destinations, and timing to detect toll fraud, SIM swaps, and spoofed numbers.

- Bot-driven abuse: AI can detect bot-led automated calls, messages, and emails. It can detect unusual traffic patterns and block such behavior before it impacts service quality.

What are the challenges of AI fraud detection?

AI brings powerful tools that help us fight against fraud. However, to realize their full potential, organizations must overcome a few challenges. A few common challenges include:

1. Evolving fraud tactics

Fraudsters constantly change their strategies to bypass detection systems. Therefore, AI models must be updated with new data to keep pace with emerging fraud patterns.

2. False positives

AI may incorrectly flag legitimate behavior as fraudulent, which can lead to customer friction, blocked transactions, and operational inefficiencies. Therefore, for new-age organizations, balancing sensitivity and precision is a persistent challenge.

3. Data quality and availability

Effective AI depends on accurate, labeled, and diverse data. In fraud detection, labeled fraudulent cases are rare and incomplete. Therefore, it is difficult to train models that generalize well to real-world scenarios.

Future of AI in fraud detection

The future is driven by AI. There are many statistics that support this. According to Deloitte, potential fraud losses for FSI in the United States alone could reach US$40 billion by 2027, a compound annual growth rate of 32%. And 71% of financial institutions turn to AI to fight faster payments fraud, as stated by PYMNTS.

Attackers are going to use AI more and more. Therefore, to combat the scale of fraud, organizations will have to use AI to prevent, detect, and combat such threats. Considering that one must be extremely cautious while dealing with frauds, you can partner with an experienced and trustworthy technology partner who can help you navigate AI for fraud detection.

FAQs

1. How do banks use AI for fraud detection?

Banks use AI to monitor transactions in real time, analyze customer behavior, and detect unusual patterns that indicate fraud. AI helps identify activities such as account takeovers, identity theft, and unauthorized transactions.

2. What are the main challenges of implementing AI for fraud detection?

The main challenges include limited access to labeled fraud data, constantly evolving fraud techniques, and managing false positives. Additionally, complex AI models can be difficult to interpret (impacting compliance), and integrating AI into existing systems may require significant time and resources.

3. What is the best AI model for fraud detection?

There isn’t a one-size-fits-all model. The best choice depends on the data and context. However, commonly effective models include XGBoost, Random Forest, and Neural Networks. For more complex fraud patterns, Graph Neural Networks (GNNs) are particularly useful in uncovering fraud rings and relational anomalies.

4. What is an AI technique for fraud detection?

A popular AI technique is anomaly detection. It works by identifying patterns that deviate from normal behavior such as unusual transaction amounts or login locations. This method is especially effective for detecting new or previously unseen types of fraud.