Customer background

Our client is a leading bank that serves a diverse customer base, including individuals, small businesses and large corporations. The bank offers a wide range of financial products and services, including loans, credit cards and investment accounts. The bank is committed to providing its customers with the best possible financial services and to making a positive impact on the community.

Challenges

Our client, a leading bank, offers a wide range of financial products and services that can be challenging for customers to comprehend. This leads to long wait times for customer service, as customers often have to call the bank multiple times to get the information they need.

The bank also lacks a centralized repository for information, which makes it difficult for customers to find the information they need. This situation is urgent because it is causing customer dissatisfaction and escalating support costs. The bank needs to find a solution to this problem quickly.

Consequently, it resulted in customer dissatisfaction and escalated support costs.

Recognizing the need for a more personalized approach, our client aimed to enhance customer interactions and provide customized recommendations.

Moreover, the client was looking for a scalable and cost-effective solution to address the challenges mentioned below:

- Simplifying complexity of products and services

- Need for personalization in customer interaction

- Creating a knowledge base for employees and customers

Solutions

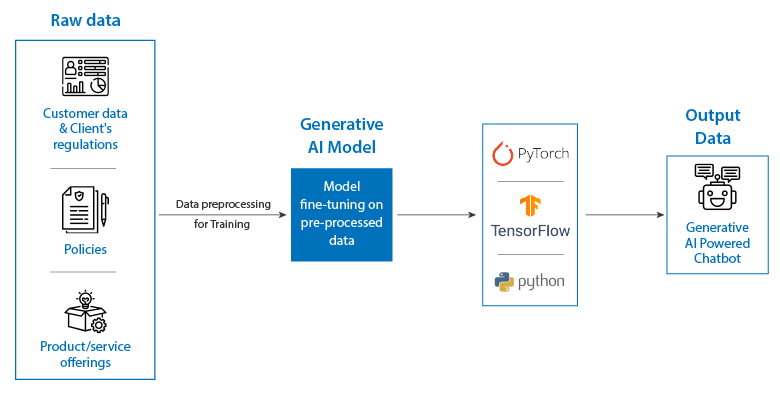

Softweb Solutions worked with a client to understand their specific needs and developed a solution that was tailored to their specific requirements. The solution consisted of three parts: Our team approached the project with a clear understanding of our client’s requirements, devising a three-part solution to address each concern precisely.

-

Softweb Solutions proposed building a generative AI chatbot to simplify the complexity of the client’s products and services. Our team opted for the generative adversarial network (GAN) model because it can be trained on vast datasets of customer interactions to generate realistic and contextually appropriate responses.

Our experts extensively gathered information about the product and service offerings and trained the chatbot using natural language processing (NLP). The aim was to create an interface capable of understanding the context of input information and delivering accurate and appropriate responses.

The chatbot underwent rigorous testing using complex scenarios and frequently asked customer questions. Implementing this solution promises better customer satisfaction, reduced support costs, and heightened customer engagement.

- Leveraging the power of generative AI in banking, we automated customer service processes, resulting in reduced wait times and improved customer satisfaction. Through training the model on sentiment analysis, it acquired the ability to understand customer emotions, enabling it to modify its responses accordingly. The model was also trained in social skills to deliver a more personalized and human-like experience. This cultivated captivating and gratifying experiences, leading to higher brand loyalty.

- In the final phase of the project, we addressed the challenge of a centralized repository by creating a comprehensive knowledge base for both employees and customers. We trained the generative AI application on the client’s regulations, policies, and product/service offerings. This empowered employees and customers to easily access up-to-date and accurate information. The outcomes include reduced support costs, enhanced customer satisfaction and increased employee productivity.

Dashboard

-

Technologies / Platforms / Frameworks

PyTorch, TensorFlow, Python -

Benefits

- Improved customer satisfaction

- Reduced support costs

- Increased employee productivity

- Automated customer service

- Improved customer engagement

- Comprehensive knowledge base

- Increased customer retention

- Personalized marketing experience

- Increased customer loyalty

Decades of Trust & Experience

1630+

Projects

545+

Technocrats

26+

Products and Solutions

1020+

Customers

Similar Case Studies

Consolidated acquired product catalogs into a unified PIM for a global semiconductor leader

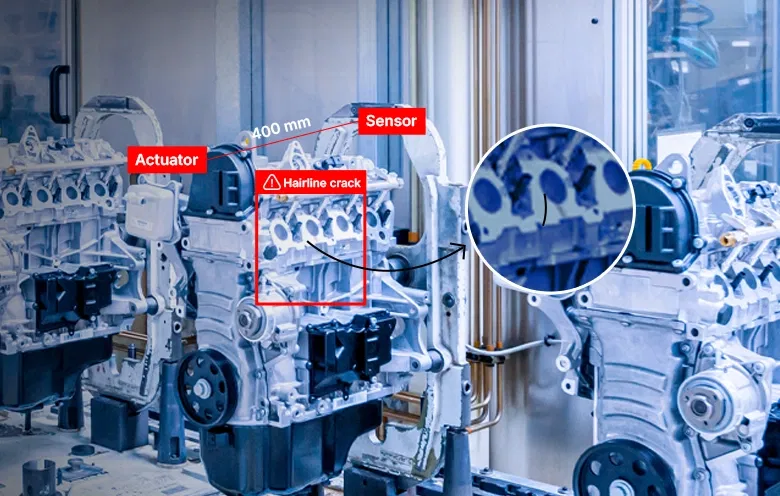

Enhanced quality control system for a manufacturing company with machine learning

Automatic defect detection on semiconductor wafer surfaces using deep learning

Connect Now

Our experts would be eager to hear you.