Customer background

The client is a market leader in the finance business with over 10 million customers. They examine legal documents related to new market products or investments, such as prospectuses, term sheets and pricing sheets with their banking customers.

According to Gartner, 80% of leaders in the financial sector are already using some form of RPA for various purposes

Challenges

Every banking organization deals with heaps of recurring documents. Despite using document management systems (DMS), they still face document inconsistency, security and integration issues with internal systems like CRM and ERP. The amount of time spent on processing each document requires attention to develop corrective and time-effective measurements.

Our client was no exception. Their primary concern was to streamline the entire document process method and save up to 40% of the time spent on handling documents. By resolving these challenges, they aimed to optimize accuracy for their reports that would impact their financial decision-making. Extracting data from their documents was a lengthy process for them, as it included the following issues:

- Manual document processes

- Categorizing different document types

- Lack of accuracy in interpreting the text

- Processing unstructured documents

- Validating multiple data points

- Document inaccuracies leading to financial loss

Solutions

At Softweb Solutions, we understand that time is a crucial factor for any banking organization’s ability to make the most of their financial services. Our team of experts analyzed their time-intensive document processing approach and recommended robotic process automation (RPA).

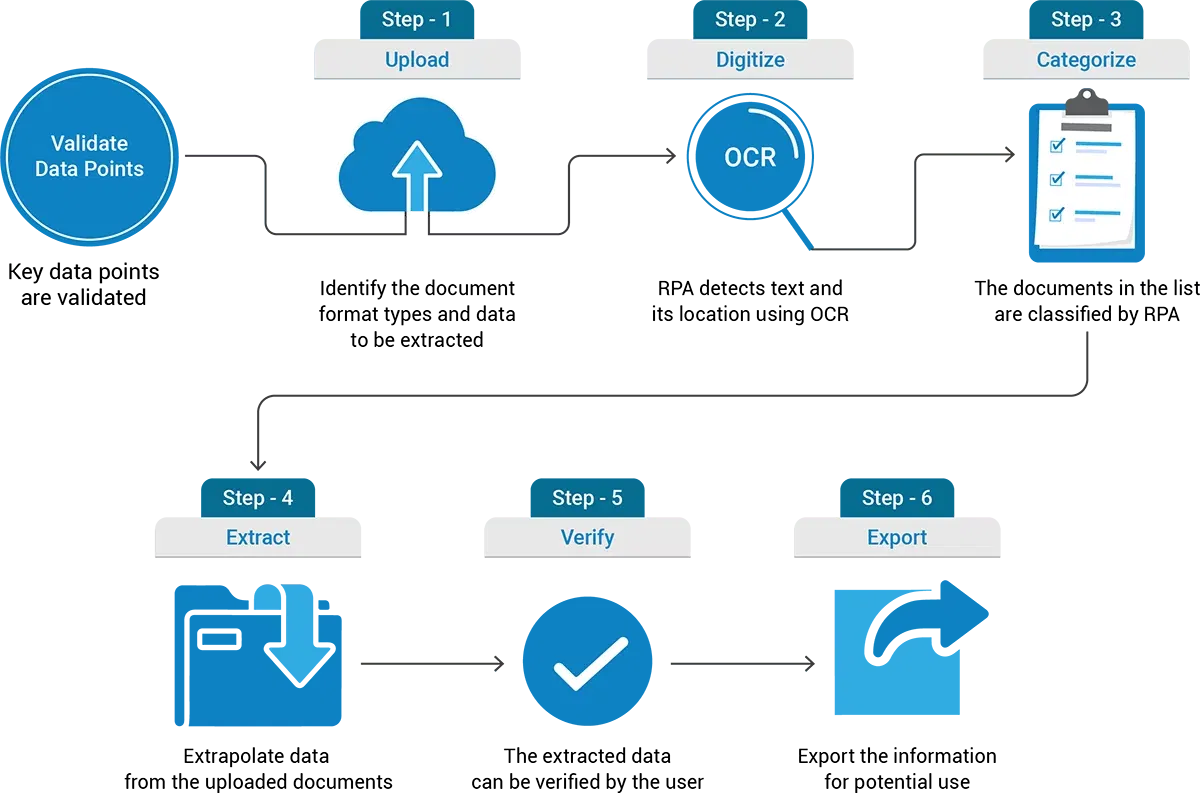

We decided to implement RPA in banking and finance to extract and interpret data from different documents and ensure end-to-end document processing. RPA uses optical character recognition (OCR) technology to speed up data extraction time and ensure document quality. It can use a simple workflow to export the documents to where they need to go.

Using our RPA in banking and financial sector solution, they can now swiftly scan any document to identify any gap or inconsistencies, as well as perform the following capabilities:

- Extract application data

- Flag missing documents

- Classify documents for future use

- Validate key data points

- Route workflow automation

- Increase accuracy and speed

- 75%

Workflow automated

- 30%

FTE equivalent savings

- 65%

Seamless operations

- 80%

Data-driven decision

Workflow

-

Industry

-

Technologies / Platforms / Frameworks

RPA, Power Automate, ASP.NET MVC, C#

Decades of Trust & Experience

1630+

Projects

545+

Experts

26+

Products and Solutions

1020+

Customers

Similar Case Studies

Transforming equipment calibration: A mobile app solution for enhanced efficiency

Empowering wealth management operations with GenAI solutions

Implemented MuleSoft for API development for a finance company

Connect Now

Our experts would be eager to hear you.