Customer background

Our client is a trusted brand in the banking and finance business. Headquartered in the US, the company has significant operations in territories across Asia, Europe, North America and South America serving millions of customers. With its established presence in commercial and retail banking and wealth management – the client’s unique competitive offerings have allowed them to stand out.

Challenges

The client needed a digital upgrade in their 30-year-old core banking capabilities. Their main goal is to stay ahead in the market and deliver tangible outcomes for today’s tech-savvy consumers. When they approached Softweb, their existing infrastructure included software developed in languages like PL/I, Assembler, JCL and CICS. They were managing their data in DB2, VSAM and ADABAS. Further, their reporting, monitoring, sorting and scheduling tools were also based on legacy systems.

The question was not about adopting a change. Rather, how efficiently the company can implement the change without affecting existing services and products that serve many consumers in their daily lives.

Some specific challenges were:

-

Inability to mine data In the old systems, they had flat files. Data fields could not store the free text; hence, there was no functionality to mine the data, search for the data, run a specific business rule, etc.

- New features integration challenges The database had no graphical user interface. It was all command line or code-driven and incapable of enabling on a mobile platform. Integrations with technologies like GPS were not possible. Consequently, cloud integration was beyond thoughts.

- Lack of documentation The biggest hindrance was the lack of documentation of existing legacy systems. The goal was still focused on uninterrupted data flow, hassle-free maintenance, seamless integration and operational flexibility.

Solutions

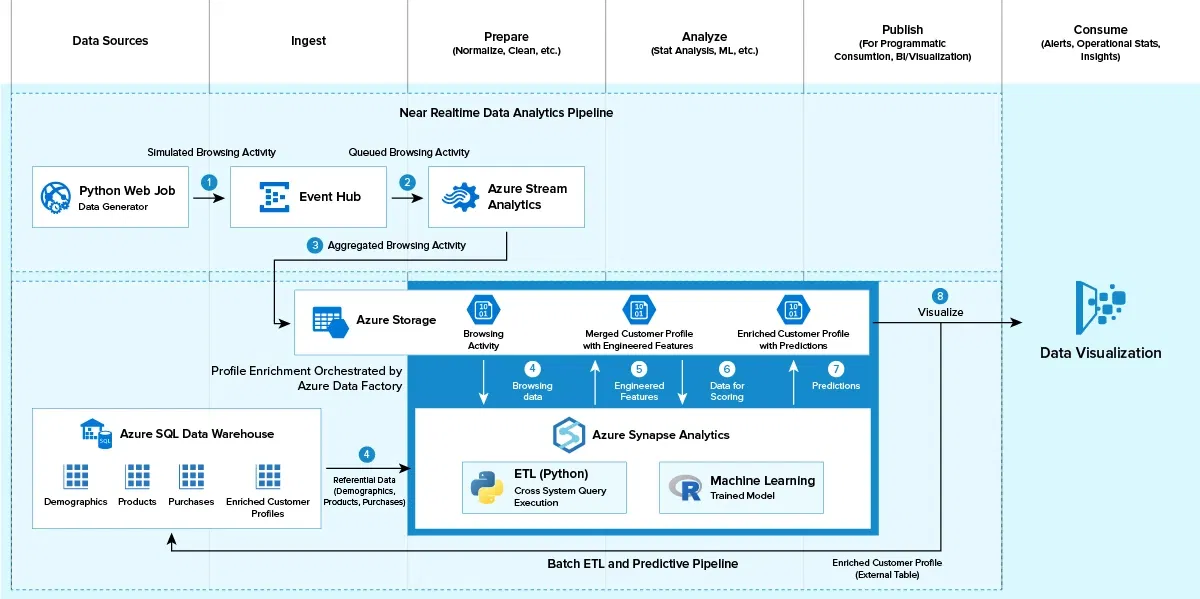

We started the legacy application modernization by ingesting the data that emerged from the company’s disparate systems. Data ingestion helped the company channel vast amounts and different types of unstructured data from various sources. The data analytics pipeline does data preparation, cleaning, enrichment and near real-time analysis. The pipeline publishes its analysis through visualization. That’s how it generates insights to support business decisions.

In essence, we shifted the company’s IT model from on-premises systems to cloud-based and related innovative technology solutions. It implies a change from a complex, manual, time taking, rule-based approach to simple configurations such as the self-service analytics framework and data lake architecture.

With a data warehouse in action, the company’s departments can use different data sets efficiently. That makes informed decision-making quick and easier. For instance, there was no connection between the data of the legacy accounting system and the new insurance hand. With app modernization, a complete picture of the customer lifecycle emerges. Meaning, a home buyer applying for a mortgage now triggers an opportunity for the company to pitch insurance. That helps the company with incremental revenue. It also enhances the customer experience.

Apart from that, we made their services accessible via APIs. We modernized the company’s legacy systems by keeping their core products or services as it is. Further, we added the following functionalities by leveraging AI and ML models:

Churn prediction

- Identify customers who are likely to churn

- Develop loyalty programs and retention campaigns

- Understand what causes a client to discontinue using the company’s services

Sentiment analysis

- Know what customers want before they do

- Increase customer-driven product enhancements

- Improve customer acquisition and customer experiences

Customer segmentation

- Develop a distribution channel led by data

- Understand who are most valuable customers and why

- Increase customer loyalty with customized content and interactions

Dashboard

-

Industry

-

Technologies / Platforms / Frameworks

Azure Stream Analytics, Azure Data Warehouse, Power BI

-

Benefits

- Promote personalized services

- Full control over the customer life cycle

- Massive savings in operating expenses

- Nurture a data-driven brand perception

- Create targeted marketing campaigns

- Identify new business opportunities

Decades of Trust & Experience

1630+

Projects

545+

Experts

26+

Products and Solutions

1020+

Customers

Similar Case Studies

Empowering wealth management operations with GenAI solutions

Implemented MuleSoft for API development for a finance company

A modern web-based solution for enhanced data control and collaboration

Connect Now

Our experts would be eager to hear you.