Insurance bot development services

Automate claim validation and accelerate claims processing with AI insurance bots that deliver real-time updates and personalized assistance for faster resolutions

Let’s discuss your requirementOur Clients

The insurance sector can save up to $12 billion with the use of chatbots. Artificial intelligence powered chatbots can deliver faster, efficient, and automated claim management and underwriting. We can build AI integrated chatbots for various types of insurance such as

Finding new ways to help customers save their hard-earned money is a great way to increase customer engagement and loyalty. Let them know how they can save some bucks on a regular basis and they will keep coming back to you, increasing customer engagement in the long run.

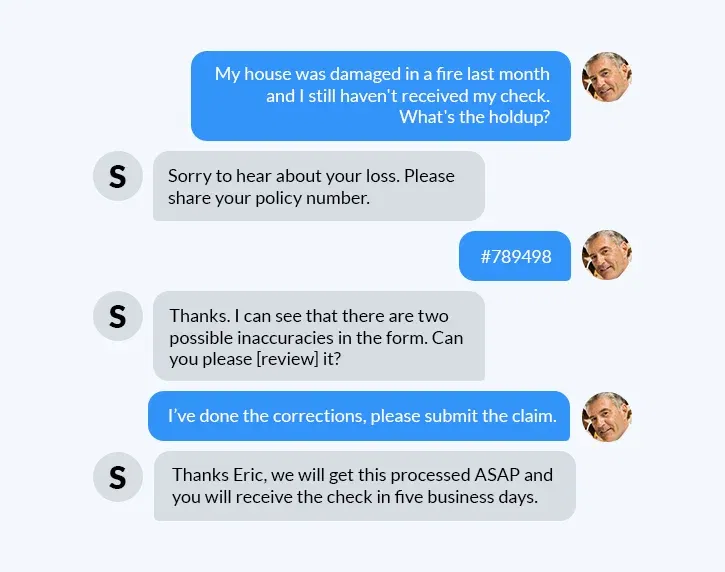

An insurance bot can keep track of claim status and any changes made by customers. Before reflecting the changes done by customers, let them verify the changes made, so as to eliminate errors. The insurance bot can also look out for inaccuracies and inform the customer if any inaccuracy is found in his claims form. Such a feature can save a lot of time and make the claims process faster for the customers.

Customers often struggle to calculate their premium. An insurance bot can calculate the premium and eligibility of customers based on their age and medical condition. Not only that, an insurance bot can also provide customers with a faster and hassle-free way to pay their premium.

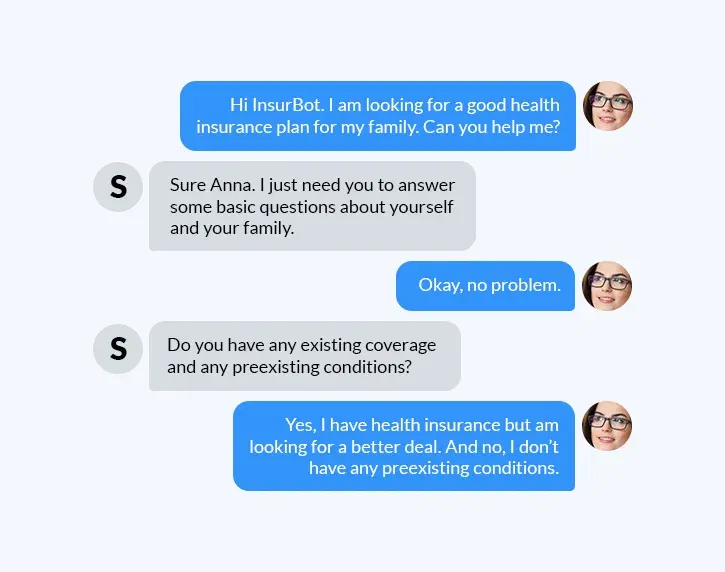

Softweb Solutions can help you deploy virtual insurance agents in the form of bots. Insurance companies are often bombarded with basic customer queries that usually consume a lot of manpower, time, and resources. More than 80% of customers are willing to abandon a company due to bad customer service. An insurance bot will provide relevant information to your customers quickly and promote the concept of self-service among them.

Our bots are compatible with the most popular collaboration channels, thus extending your reach.

We take a personalized approach to designing, developing, and deploying intelligent bots according to your business requirements.

Our bot development service adopts a faster and easier approach so that you can reap maximum business benefits.

Start a conversation!

Build trust and deepen customer bonds with reliable insurance bot capabilities.