Customer background

Our client is a growing manufacturing company that produces industrial machinery and replacement parts for a variety of sectors, including construction, logistics, and heavy engineering. They operate across multiple regions and deal with thousands of customers and vendors, many of whom are on credit terms.

Challenges

Over the years, as business grew, their finance operations began to show signs of strain. What was once a manageable invoicing process gradually turned into a time-consuming routine.

And although SAP managed their core systems, their finance team still had to log in, pull reports, verify payments, and manually follow up with customers on overdue invoices. What should have been a routine task was consuming several days each week—and still left room for error.

At first glance, the issue seemed simple: unpaid invoices were slipping through the cracks. But a closer look revealed deeper, systemic problems including manual reporting, time-consuming validations, and inconsistent follow-up routines. A few major challenges we discovered are listed below.

Manual, repetitive tasks were taking up too much time

Each week, their team logged into SAP, exported multiple reports, compared them manually, and matched payments line by line. It took two to three full days just to get a clear picture of what was overdue.

Errors were slipping through

Given how repetitive and detail-heavy the task was, they often missed entries or made mismatches, especially under tight deadlines. Therefore, their follow-ups weren’t always accurate, and in some cases, no reminder was sent.

Communication delays were affecting collections

Emails were drafted manually, and they had to be customized with invoice details for each customer, therefore, reminders often went out late. This impacted how quickly customers responded and ultimately slowed down cash collection.

Over-reliance on people for a routine task

The whole process depended on a few people who had deep familiarity with both the reports and the customers. If someone was out or overloaded, the process would stall. It wasn’t scalable or sustainable.

The finance team had already tried a few workarounds—Excel trackers, shared folders, and template emails—but nothing stuck. Therefore, they needed a more dependable approach that would take the pressure off the team and ensure reminders went out regularly and accurately.

Solutions

When we started working with the client, we didn’t pitch a tool first. Instead, we spent time with the team to walk through what they were doing today, step by step.

We asked questions like:

- What makes an invoice “overdue” in your system?

- How do you know when a customer has partially paid?

- What kind of details do you usually include in your emails?

This helped us understand both the technical steps and the judgment calls the team was making. It also showed us where automation could genuinely help—and where human input was still needed.

Process review and planning

- We mapped out the full process from start to finish—everything from SAP logins to how the final email got sent.

- Together with the credit control team, we defined the rules for classifying invoices as overdue, including logic for partial payments, expected payment dates, and customer-specific terms.

- We reviewed sample emails they’d sent manually and helped structure a few standard templates that still felt personal and relevant.

- More importantly, we didn’t try to automate everything. We focused on the repetitive parts—the tasks that took more time and offered little value when done manually.

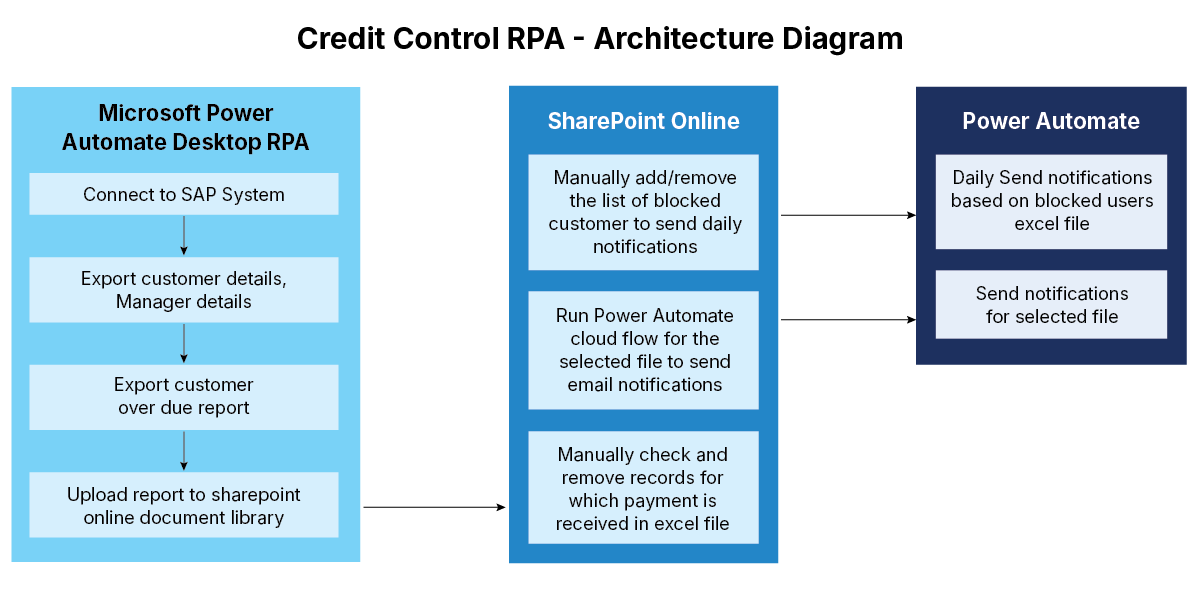

Building the automation in Power Automate Desktop

We used Power Automate Desktop to build a bot that:

- Logs into SAP with secure credentials

- Extracts key reports like the aging report and payment status report

- Cross-checks open invoices with actual payments received

- Flags anything overdue based on the agreed logic

- Prepares customer-specific Excel summaries

- Sends out personalized reminder emails with the relevant Excel file attached

- Runs on a weekly schedule, so the team doesn’t have to remember or trigger it manually

- Sends an alert if something goes wrong—like if SAP is down or a report fails to generate—so the team can step in quickly

Testing and Rollout

We ran multiple rounds of testing with real customer data to make sure the automation was matching the finance team’s manual checks. During User Acceptance Testing (UAT), we simulated edge cases—like late partial payments or mismatched currencies—to see how the bot handled them.

We rolled it out in phases, starting with a few customer groups, and expanding once the team was confident in the results.

We also trained the internal finance ops lead on how to update templates or adjust schedules without needing tech support.

-

Industry

-

Technologies / Platforms / Frameworks

Power Automate Desktop, Robotic Process Automation (RPA)

-

Benefits

Saved 2–3 working days per cycle

By automating report extraction, validation, and follow-up emails, the finance team reclaimed up to three full days every week. What was once a slow, manual routine now running in the background—freeing the team from repetitive tasks and last-minute scrambles.

Significantly reduced error rates

Manual matching of invoices and payments often led to inconsistencies, missed entries, or follow-ups sent to the wrong customers. With automation in place, data validation became systematic and consistent—bringing accuracy levels up and giving the team confidence in what was being sent out.

Improved customer response times

Because reminders were now timely, clear, and included the right details from the start, customers had fewer questions and were quicker to act. This led to a noticeable improvement in collections and reduced the back-and-forth often caused by unclear or delayed emails.

Freed up the finance team for strategic work

With the manual load off their plate, the team could shift their focus to higher-value activities—like analyzing customer payment trends, refining credit policies, or proactively managing risk. This shift helped elevate the role of finance from task execution to business partnering.

Created a scalable and dependable process

The automated workflow ran on a schedule, handled exceptions, and didn’t rely on any single person to function. As the business grew, the same setup could support more volume without needing to hire additional staff or rework the process—making it a long-term, future-proof solution.

Decades of Trust & Experience

1630+

Projects

545+

Technocrats

26+

Products and Solutions

1020+

Customers

Similar Case Studies

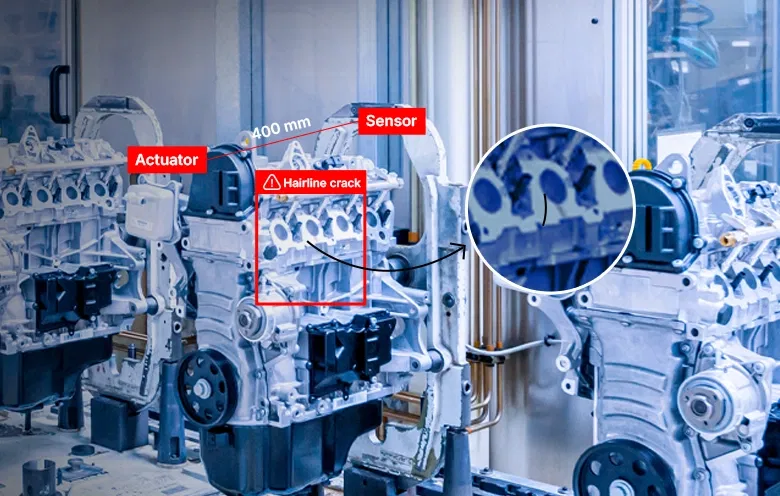

Enhanced quality control system for a manufacturing company with machine learning

Transforming battery management with IoT-powered insights

Enhanced workplace safety for a manufacturing company

Connect Now

Our experts would be eager to hear you.