In 1998, Progressive Insurance dared to ask, “What if we price policies based on how people drive, not just who they are?” Traditional insurance relied on age, zip code, and driving history. Data’s role was limited to basic categorization and processing historical claims.

That idea, usage-based insurance, is now adopted by major insurers like State Farm, Allstate, and Geico. It has grown into a $50 billion market. The role of data analytics in the insurance industry has evolved from a cost center to a revenue accelerator.

Still, most insurers use only 6,75,000,000,000,000,000 (that is 27%) of the 2.5 quintillion bytes of data they generate daily. This includes data from customer interactions, claims, compliance, and external sources. The gap is massive. So is the opportunity. Lemonade, Inc. is a notable example. By implementing custom data science solutions, it now settles claims in three seconds. Traditional carriers still take up to three weeks.

Progressive and Lemonade are among many examples that demonstrate how data analytics is reshaping the industry, from pricing and underwriting to fraud detection and customer experience. This blog dives into those real-world examples. It covers where data analytics delivers the most value, what leading insurers are doing differently, and which trends will shape 2025 and beyond.

Why data analytics is important in the insurance industry

The insurance industry faces serious pressure. Fraud is rising. Customers leave more easily. Insurtechs and traditional players are fighting for the same market. Regulations are stricter. Customers expect instant quotes, faster claims, and digital experiences as smooth as Amazon.

To meet these demands, insurers need more than digital tools. They need better decisions, faster, smarter, and at scale. That’s where data analytics comes in. It enables real-time underwriting, faster fraud detection, and more accurate risk assessment. It also helps personalize products and streamline operations across the value chain.

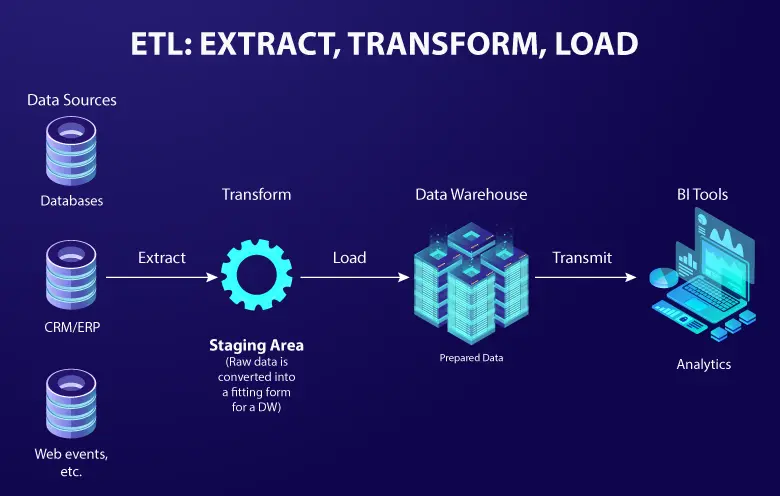

Analytics transforms insurers from reactive organizations to proactive enterprises. This shift moves insurers beyond asking “What happened?” to focus on “What will happen next?” and “How can we influence that outcome?” Leading insurers build data ecosystems powered by data engineering capabilities that deliver insights across every function. This creates advantages that continue to grow over time.

Performance impact: Traditional methods vs. Modern analytics

The transformation from traditional insurance practices to analytics-driven operations delivers measurable improvements across every critical business metric. The shift is not just about technology. The results speak louder. Here’s how the numbers compare:

| Performance metric | Traditional methods | Modern analytics |

|---|---|---|

| Risk prediction accuracy (%) | 67.3 | 89.4 |

| Average processing time (Days) | 15.0 | 2.4 |

| Variables analyzed per assessment | 20 | 1000+ |

| Data utilization rate (%) | 23.5 | 75.8 |

| Error rate in processing (%) | 8.3 | 2.1 |

| Pattern recognition rate (%) | 45.2 | 83.2 |

| Customer satisfaction score (0-100) | 65.4 | 83.2 |

| Claims fraud detection rate (%) | 52.3 | 87.2 |

| Risk classification accuracy (%) | 71.2 | 89.7 |

| Data sources integrated | 8 | 94 |

| Documentation error rate (%) | 12.4 | 3.2 |

| Cost per risk assessment (USD) | $245 | $27 |

Source: International Journal for Multidisciplinary Research

The difference is clear. Traditional insurers rely on a few dozen variables and take over two weeks to process a claim. Analytics-driven insurers assess over a thousand data points, including behavior, weather, and economic signals, and deliver results in two days or less.

They also spend less, almost 90% less, on risk assessment and serve customers better.

7 benefits of data analytics in the insurance industry

Data analytics delivers seven transformative benefits that create sustainable competitive advantages for insurance companies. These outcomes work together, amplifying each other to generate compound value that competitors struggle to replicate.

Benefit 1: Precision risk assessment and dynamic pricing

The foundation of profitable growth

The traditional problem

Insurance companies price policies by zip codes. A careful driver in a high-crime area pays inflated premiums. A reckless driver in a safe neighborhood gets undercharged. Companies either lose money or avoid entire markets.

The analytics solution

Allstate’s telematics technology tracks actual driving behavior through mobile apps and plug-in devices:

- Speed patterns reveal conservative vs. aggressive driving

- Braking habits show anticipation skills

- Cornering indicates risk-taking behavior

- Driving time identifies statistical risk periods

- Route choices differentiate highway vs. city risk profiles

The result

Maria, a careful teacher in a high-crime Chicago neighborhood, traditionally paid $2,400 annually based on her zip code. Allstate’s behavior data revealed she drives only during daylight, never speeds, takes safe routes, and parks in secure garages. Her fair price is $1,600.

Allstate’s 2024 results show their telematics program achieved a 27% improvement in loss ratios through granular risk segmentation. On their $64.1 billion annual premium revenue, even a 25% improvement on 20% of their portfolio creates massive profit increases while capturing market share in previously unprofitable areas.

Benefit 2: Autonomous claims processing and fraud prevention

When machines see what humans miss

The traditional burden

Claim processing takes 2-4 weeks. Human adjusters cost $75-150 per deployment, with inconsistent assessments. Fraudsters exploit lengthy investigation periods to perfect deceptive narratives.

The analytics advantage

State Farm’s AI-powered system processes claims in 60 seconds:

- Computer vision analyzes damage instantly from customer photos

- Algorithms assess repair costs using parts, labor, and local pricing data

- Fraud detection runs automatically in the background

- Payment approval happens before customers leave accident scenes

The impact

State Farm reduced processing costs by 40% while eliminating human adjuster deployment for 80% of claims. Settlement time dropped from weeks to minutes. Customer satisfaction improved through faster resolution.

Benefit 3: Hyper-personalized customer experiences

USAA’s military precision applied to insurance

The proactive advantage

USAA’s analytics predict Marine deployments 30 days early using deployment orders, base addresses, and credit card patterns. Before Marines consider insurance implications, USAA offers vehicle storage discounts, overseas coverage adjustments, and family communication setups.

The segmentation power

Analytics segment customers by life transitions: career progression, marriage, family planning, geographic moves, and retirement. Each creates specific insurance needs and optimal contact timing.

The business result

USAA discontinued mass advertising and poorly converting campaigns. They focused on retention, cross-selling, and referral generation through hyper-personalization, creating premium customer relationships despite higher pricing.

Benefit 4: Predictive loss prevention and risk mitigation

Liberty Mutual’s crystal ball strategy

The prevention revolution

Liberty Mutual’s smart home sensors detect water leaks hours before significant damage occurs. What would have been $50,000 in flood claims became $200 for sensor replacements.

The IoT transformation

Connected devices shift insurance from reactive payment to proactive protection:

- Smart smoke detectors distinguish burnt toast from house fires

- Vehicle sensors detect mechanical failures before breakdowns

- Security systems learn patterns and flag anomalies

The competitive moat

Liberty Mutual’s smart home program reduced claims frequency by 20%. Customer retention increased by 35% in smart home segments because switching feels like removing security. Prevention creates a virtuous cycle: fewer claims enable lower premiums, which attract better risks and further reduce claims.

Benefit 5: Operational excellence through intelligent automation

Travelers’ efficiency engine

The hidden optimization

Travelers deployed AI to optimize behind-the-scenes processes, discovering 30% of human work could be automated without quality loss.

The systematic improvements

- Claims with rental cars process 40% faster with certified adjusters; automatic routing ensures optimal assignment.

- Machine learning forecasts call spikes 48 hours ahead, enabling perfect staffing without excess costs.

- Algorithms rebalance resources across departments during demand cycles.

The pricing weapon

Travelers’ 30% operational cost reduction creates sustainable pricing advantages. During competitive battles, they underprice rivals while maintaining healthy margins, forcing competitors into unprofitable responses.

Benefit 6: Regulatory compliance as competitive advantage

MetLife’s regulatory jujitsu

The compliance transformation

MetLife’s automated systems continuously scan decisions for violations. Pricing algorithms prevent discrimination. Marketing content gets pre-approved through regulatory language systems.

The speed advantage

MetLife launches products 60% faster because compliance verification occurs in real-time during development, not as a final approval. While competitors wait months, MetLife captures first-mover advantages.

The regulatory moat

Complex compliance requirements that intimidate new entrants become MetLife’s protection. Their automated efficiency handling makes it difficult for competitors to match their speed and accuracy.

Benefit 7: Strategic market intelligence and product innovation

AIG’s future-seeing machine

The early warning system

AIG’s intelligence platform processes signals from patent filings, social media conversations, and economic indicators to predict market shifts.

The innovation examples

- Identified cyber insurance demand in 2018 by analyzing vulnerability reports and breach patterns.

- Used satellite imagery to spot property risk shifts years before climate reports.

- Predicted regulatory changes a few months early through document analysis.

The first-mover economics

Being first in profitable new categories creates sustainable advantages. AIG’s early leadership in cyber insurance established pricing power and market credibility that persists as competitors enter. Their systems also identify declining markets early, preserving capital for better opportunities.

How the above seven benefits create interconnected advantages

These seven benefits can work independently and also form an integrated system, where each amplifies the others.

Smart home insurance example:

- Precision assessment: IoT sensors provide granular property risk data

- Autonomous processing: Sensor data enables instant damage assessment

- Personalized experience: Proactive protection feels like a premium service

- Loss prevention: Sensors prevent claims before they occur

- Operational excellence: Automated monitoring reduces oversight costs

- Compliance advantage: Transparent data proves fair pricing practices

- Market intelligence: Usage patterns reveal new market opportunities

This interconnected approach creates compound value, which later translates into sustainable advantages for insurers.

Suggested: Benefits of data analytics

Use cases of data analytics in insurance

The transformation of data analytics from operational support to strategic weapons requires understanding how leading insurers deploy these capabilities to create lasting competitive advantages.

Predictive underwriting

Transform risk assessment into a strategic advantage

- The challenge: Traditional underwriting relies on historical data and broad demographic categories, which can create adverse selection spirals. Low-risk customers tend to migrate to competitors offering better rates, while high-risk customers often concentrate on carriers that use outdated pricing models.

- Analytics solution: Data analytics solutions analyze hundreds of data points, from credit patterns to social media behavior, creating granular risk profiles that identify profitable segments invisible to traditional approaches. Nationwide’s advanced models continuously refine predictions based on claim outcomes and external data integration.

- Impact: Insurers retain more profitable customers by offering fair, personalized premiums. Improved pricing accuracy lowers exposure to high-risk profiles and reduces loss ratios. Underwriting becomes a growth driver instead of a cost center.

Intelligent claims processing

Speed as strategic differentiator

- The challenge: Manual claims processes delay settlements and frustrate customers. Inconsistent evaluations can lead to disputes, damage trust, and increase regulatory scrutiny. Rising claim volumes compound inefficiencies and increase overhead costs.

- Analytics solution: Data analytics-powered systems triage claims instantly, estimate damages using image recognition, and route complex cases to the right specialists. Natural language processing helps flag fraud while ensuring fair, consistent treatment. These improvements also enhance communication, transparency, and overall customer experience throughout the claims journey.

- Impact: Claims get resolved faster, with greater consistency and fewer disputes. Customers feel informed and valued, leading to stronger relationships and increased satisfaction. Insurers also reduce handling costs while improving operational focus.

Dynamic pricing

Real-time competitive positioning

- The challenge: Static pricing models fail to capture individual risk variations and market dynamics, creating opportunities for more sophisticated competitors to capture profitable customers through superior pricing accuracy.

- Analytics solution: Real-time pricing engines combine telematics, behavioral data, and market trends to adjust premiums based on actual risk rather than relying on broad statistical categories. Advanced algorithms ensure pricing remains competitive while protecting margins.

- Impact: Insurers can offer fairer premiums, adapt to shifting risk profiles, and respond to market dynamics without manual rework. Customers benefit from personalized pricing that aligns with their behavior and risk levels.

Predictive customer retention

Keep your most valuable customers longer

- The challenge: Insurers struggle to differentiate between price-sensitive customers and those seeking value-added services, leading to inefficient marketing spend and suboptimal retention strategies that benefit competitors.

- Analytics solution: Predictive models identify patterns across interactions, payment behavior, and external data to flag customers likely to churn. These insights power personalized retention strategies and targeted product recommendations that resonate with high-value segments.

- Impact: Retention improves through timely, relevant outreach tailored to customer needs. Acquisition resources are utilized more effectively while existing customer relationships strengthen and become more profitable.

Emerging technologies: Building tomorrow’s competitive architecture

The next wave of insurance analytics will be defined by emerging technologies that reshape how insurers collect, process, and act upon data, as explained in the two tables below. Understanding these technological shifts is crucial for strategic planning, as early adopters will establish competitive advantages that become increasingly difficult to overcome.

Technologies reshaping insurance analytics

These technologies redefine the boundaries of what’s possible. Each serves a unique strategic role that helps insurers move from reactive operations to real-time, data-driven performance.

| Technology | Strategic role | Competitive applications |

|---|---|---|

| AI and Machine learning | Enable continuous model improvement and pattern recognition that surpass human analytical capabilities. | Advanced fraud detection, dynamic risk scoring, and personalized recommendations that increase conversions. |

| IoT and Telematics | Generate continuous behavioral data streams that enable real-time risk assessment and intervention. | Usage-based insurance, proactive loss prevention through smart devices, and personalized pricing for health. |

| Cloud Data Platforms | Provide scalable infrastructure for real-time analytics processing and secure data sharing across business units. | 360-degree customer views, business continuity support, and automated compliance reporting. |

| Real-time analytics | Enable instant decision-making that creates customer experience advantages and operational efficiency gains. | Instant fraud alerts, real-time pricing updates, and near-instant claim approvals for routine cases. |

| Generative AI | Transform analytics outputs into actionable insights and customer communications at scale. | Auto-generated policy documentation, personalized messaging, and streamlined regulatory submissions. |

Platform selection framework: strategic technology partnerships

Choosing the right analytics platform is not just an IT decision. It shapes how insurers compete, innovate, and grow. Each platform delivers distinct strategic capabilities tailored to insurance business value.

| Platform | Strategic capability | Insurance value creation |

|---|---|---|

| Databricks | Unified analytics platform that fosters collaboration between data scientists and business users. | Predictive models for underwriting, real-time fraud detection, and segmentation drive retention. |

| Snowflake | Cloud-native architecture that supports secure data sharing and governance across business units. | Centralized customer intelligence, integrated third-party data, and streamlined regulatory workflows. |

| Azure Synapse | Integrated analytics combining structured and unstructured data processing capabilities. | Claims forecasting, compliance monitoring, and real-time operational performance dashboards. |

| AWS Redshift | High-performance data warehousing optimized for complex analytical queries. | Strategic risk analysis, churn prediction, and financial reporting for competitive planning. |

| Google BigQuery | Serverless analytics platform with machine learning integration for advanced model development. | Responsive pricing engines, customer journey insights, and deep portfolio analysis for strategic planning. |

Future trends of data analytics in the insurance industry

Insurance analytics is heading toward three key shifts that will shape the industry through 2030. Embedded insurance leads the charge. It integrates coverage into digital ecosystems, from autonomous vehicle platforms to smart city infrastructure. Reports from leading insurers suggest that embedded insurance can open $722 in new premium opportunities and redefine customer acquisition.

Climate risk analytics is now a core business function. With tools like Munich Re’s satellite and IoT-driven climate intelligence, insurers gain real-time insights into property risk. Early users report 30% better catastrophe loss predictions and stronger positioning in competitive and climate-sensitive markets.

Finally, ethical AI and algorithmic transparency are moving from optional to essential. Explainable models enhance customer trust and facilitate compliance, enabling insurers to appeal to those who value fairness and are willing to pay for transparent underwriting.

How leading insurers use analytics and why you should too

The insurance industry is no longer debating whether analytics matters. It’s about who uses it best. Market leaders are already leveraging advanced analytics to sharpen risk assessment, boost operational efficiency, and engage customers more effectively. This approach drives measurable growth and solidifies its position as the customer’s preferred insurer.

Consider this: insurers adopting usage-based insurance models have tapped into a $50 billion market, while embedded insurance is projected to generate over $700 billion in new premiums by 2030. These figures are not just statistics. They are proof that data-driven strategies deliver real business results and reshape competitive landscapes.

The gap between analytics leaders and those lagging is widening fast. Those who act decisively today will capture more customers, reduce churn, and withstand digital disruption. But success requires more than just tools. It demands a culture that prioritizes data, visionary leadership to guide transformation, and strategic partnerships to accelerate scale.

The opportunity to gain an edge in this competitive market won’t wait. The question is: are you ready to make data analytics your strongest asset?

Frequently asked questions

1. How is data analytics used in the insurance industry?

Data analytics in insurance is used to improve risk assessment, streamline claims processing, detect fraud, personalize customer experiences, and ensure regulatory compliance. By combining traditional policy and claims data with newer sources, such as IoT devices, social media, and external databases, insurers gain deeper insights that enable them to make faster, smarter decisions and stay competitive.

2. What is analytics in insurance?

Analytics in insurance involves applying statistical analysis, machine learning, and data science techniques to transform raw data into actionable business insights. It covers descriptive analytics to understand past performance, predictive analytics to forecast risks and customer behavior, and prescriptive analytics to guide decisions in underwriting, claims, and customer management.

3. What kind of data do insurance companies use?

Insurance companies utilize a combination of traditional data, such as policy details, claims histories, and customer information, along with alternative data from IoT sensors, telematics devices, social media activity, credit bureaus, weather data, and third-party sources. This broad data ecosystem enables more accurate risk modeling and tailored customer offerings.

4. What is data visualization in insurance?

Data visualization in insurance converts complex data and analytics into easy-to-understand dashboards, interactive reports, and visual summaries. These tools support decision-making by illustrating risk patterns, customer journeys, claims trends, and compliance metrics, making it easier for stakeholders to grasp insights and act quickly.

5. How is predictive analytics used in insurance?

Predictive analytics utilizes machine learning models to analyze historical data and anticipate future events, such as claim frequency, customer churn, fraud risks, and pricing adjustments. Insurers utilize these predictions to automate underwriting, design effective retention strategies, prevent losses, and dynamically adjust pricing in response to market conditions.

6. How can data analytics improve claims processing?

Data analytics enhances claims processing by enabling intelligent automation that prioritizes claims based on complexity, utilizes computer vision to assess damage accurately, detects fraudulent claims through pattern recognition, predicts optimal settlement amounts, and streamlines workflows. These enhancements reduce processing time, increase accuracy, and boost customer satisfaction.